Crypto Taxes: How Does Donating Bitcoin Affect My Taxes?

For the last few years, the tax treatment of cryptocurrencies like Bitcoin in the United States was based on one document – a PDF file released by the IRS known as Notice 2014-21 (something which we’ve written about in the past with this post on “Nonprofit Tax Tips: Cryptocurrency Donations”), which covered multiple questions on taxation of this emerging asset class at the time – cryptocurrency. It applied existing tax treatment to cryptocurrency, most importantly stating that “General tax principles that apply to property transactions apply to transactions using virtual currency” which has been interpreted to mean that just like other property assets like stocks and bonds – that cryptocurrency is tax deductible when donated.

Notice 2014-21: Q-1: How is virtual currency treated for federal tax purposes? A-1: For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.

Fast forward a few years and it’s now 2019. We’ve seen huge swings in the cryptocurrency market, with Bitcoin hitting close to $20,000 at its peaks in 2018, down to around $3,000 and now back to around $10,000. It is now more mainstream, with close to 8% of adults in the United States either holding, or transacting with some form of cryptocurrency in the last year.

How Many Tax Returns Include Crypto?

The IRS currently receives around 150 million tax returns annually, meaning that they should be expecting to see somewhere in the region of around 12 million tax returns that should mention some type of cryptocurrency holding or transaction. Currently this is not the case, and with that in mind, the IRS is once again revisiting cryptocurrency in 2019, and updating it’s guidance in the form of the “Frequently Asked Questions on Virtual Currencies” that were released on October 9, 2019. The good news for cryptocurrency donors and nonprofits wishing to accept cryptocurrency, is that there is now far more clarity surrounding these types of transactions, both from the IRS, and also from accountants who need to deal with these sorts of transactions.

Yes, The IRS Addresses Bitcoin Donations Explicitly

The IRS explicitly mentions cryptocurrency donations to nonprofits in Q33 and Q34 of the document stating that:

2019 FAQ Q33. If I donate virtual currency to a charity, will I have to recognize income, gain, or loss? A33. If you donate virtual currency to a charitable organization described in Internal Revenue Code Section 170(c), you will not recognize income, gain, or loss from the donation. For more information on charitable contributions, see Publication 526, Charitable Contributions.

And

2019 FAQ Q34. How do I calculate my charitable contribution deduction when I donate virtual currency? A34. Your charitable contribution deduction is generally equal to the fair market value of the virtual currency at the time of the donation if you have held the virtual currency for more than one year. If you have held the virtual currency for one year or less at the time of the donation, your deduction is the lesser of your basis in the virtual currency or the virtual currency’s fair market value at the time of the contribution. For more information on charitable contribution deductions, see Publication 526, Charitable Contributions.

Tax Treatment of Bitcoin Donations

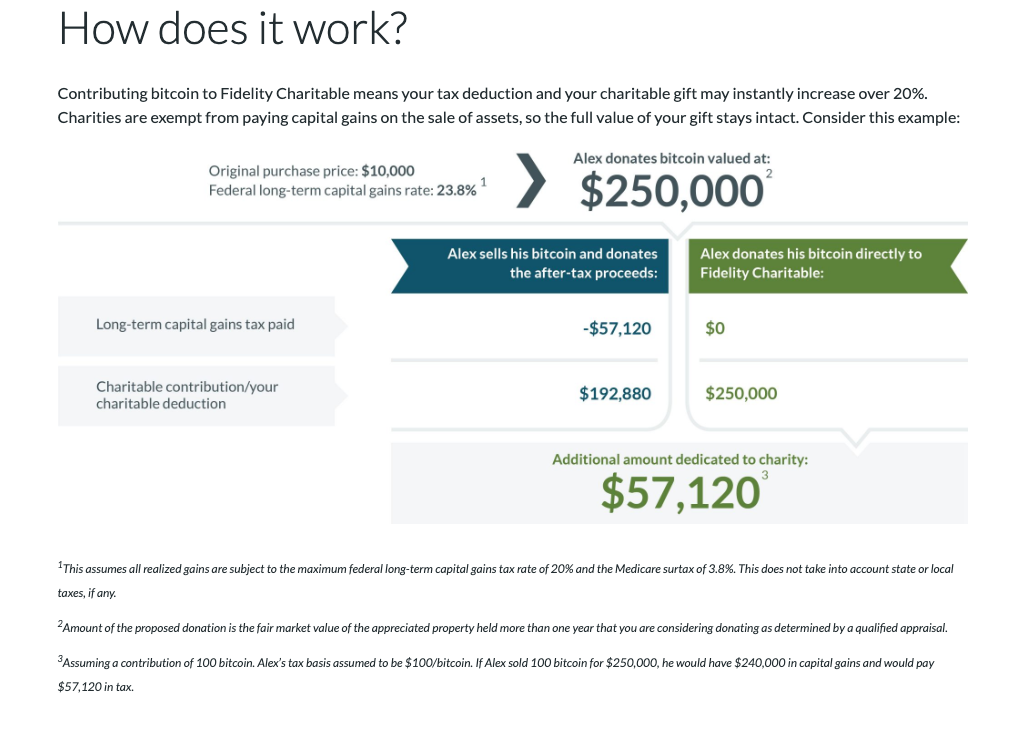

Donations of cryptocurrency to 501(c)3 or other tax exempt nonprofits that fall under Section 170(c) of the Internal Revenue Code are tax deductible, in a very similar manner to stocks and or other property.

In practice that means that you can deduct the “fair market value” of your cryptocurrency donation, such as Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Zcash, GUSD or other cryptocurrencies at the time of the donation. As per Q34, the amount that you are able to deduct depends on how long you have held your cryptocurrency:

- Your donations are not subject to capital gains tax.

- If you have held your cryptocurrency for one year or less then you can deduct the lesser of your basis in the cryptocurrency or its fair market value up to 50% of your annual gross income.

- If you have held your cryptocurrency for over a year you can deduct its fair market value up to 50% of your annual gross income.\

- Donations over $500 USD are to be reported on your form 8283 “Non Cash Charitable Contributions”. You will also need a receipt from the nonprofit for your donation, as it’s very likely that the IRS is going to want it. For any large donations (such as those over $500,000) you will need to include this receipt as proof of donation with your tax return.

When making a donation, be sure to keep a receipt to make filing with the IRS or other local tax agencies quick and easy when tax season rolls around.

Why the Updates Could Increase Crypto Donations

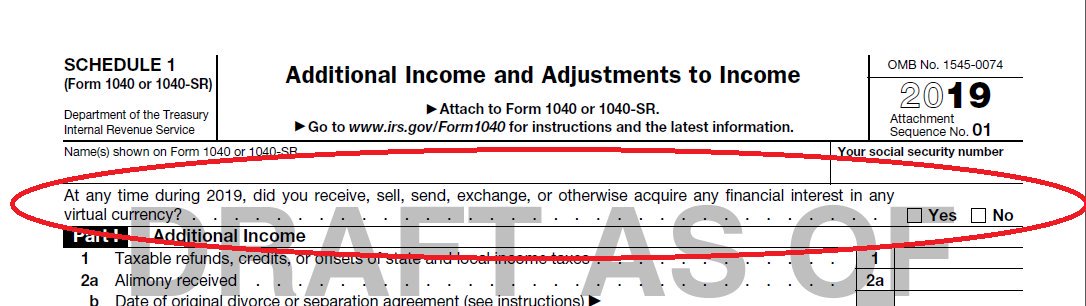

The IRS will ask taxpayers if they own cryptocurrencies in new 1040 tax form. The form will state: “At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” followed by a yes or no option.

This is the most widely used tax form for individual filers and will remind taxpayers of their cryptocurrency tax obligations which will likely lead to more charitable donations of cryptocurrency to nonprofits by holders of cryptocurrency to offset capital gains made in that tax year.

What Does This All Mean For 501(c)3 Nonprofit Organizations Who Accept Cryptocurrency?

- Most importantly, potential donors cannot donate to you if you are not able to accept cryptocurrency. This means that you should have a Gift Acceptance Policy outlining how you take cryptocurrency, have set up a solution setup so that you can accept cryptocurrency donations, and make it easy to find on your crypto donation page.

- You should make it easier for your donors to report their donations to the IRS, by providing a receipt that includes all the information you would include for an ordinary donation, such as the organizations legal name, EIN number, donor information, the date and value of the donation, preferably in both the cryptocurrency value, and the USD equivalent at the time of donation.

- You should clearly communicate that cryptocurrency donations are tax deductible when made to 501(c)3 nonprofit organizations in any marketing material soliciting cryptocurrency donations and on your donation page, such as with this example from Fidelity Charitable:

What Does This All Mean For Cryptocurrency Donors?

- Any time you realize a capital gain on a cryptocurrency asset it is a taxable event (like when you trade or cash out your crypto)

- Cryptocurrency donations to 501(c)3 nonprofits are tax deductible and do not trigger a taxable event, meaning you do not usually have to pay capital gains tax. For US donors, you should report your donation to the IRS to realize these tax benefits. Please always consult a tax professional for guidance.

- As mentioned earlier, the IRS views it that there is a large amount of noncompliance from taxpayers that currently (or have held) cryptocurrency in the past. There is a good chance that they may go back over up to 6 years worth of transaction history as they come to grips with cryptocurrency. This means that individuals who have donated cryptocurrency in previous tax years should talk to their accountants about whether it is prudent to file an amended tax return by way of Form 1040X.

- While donating anonymously might be easiest, you really should take advantage of the tax benefits for any donation and ask for a receipt. You can protect your anonymity from the nonprofit by using something like a protonmail email address, but you’ll still need to report it with the IRS.

- If donating for tax benefits, look for nonprofits that make it easy to get receipts, such as those who utilize donation solutions like that from The Giving Block which issues compliant receipts automatically.

Please note that we at The Giving Block are NOT financial advisors, tax accountants or attorneys – we just love helping nonprofits accept cryptocurrency donations. This article should not be considered financial or legal advice. Every person’s situation is different and we strongly recommend that you talk to your accountant, attorney or financial advisor before making any major financial decisions.